STORY NATALIE MAZEY

PHOTOGRAPHY MARY BARONE

The Ohio legislature approved the Fair School Funding Plan, a $75 billion comprehensive overhaul of Ohio school funding on Jun. 28, 2021. Lawmakers approved the first two years of the six-year plan, leaving it’s future uncertain. Future general assemblies hold the power to continue to fund it.

“[The Fair School Funding Plan] is the largest commitment of state resources for K-12 education in the history of the state [of Ohio],” Ohio State Board of Education President Laura Kohler said.

FORMULA

One of the most significant changes within the Fair School Funding Plan is the alteration of the base cost, the amount per-pupil the state pays. Before the Fair School Funding Plan, the base cost was $6,020. Now, this cost is based on the expenses individual districts are facing, including transportation, teacher salaries, and direct classroom instruction, making it a unique calculation for every district.

“Local costs are now included in the base cost methodology,” Lakota Treasurer Jenni Logan told Spark. “It’s not just some number that’s based on something that somebody came up with in Columbus.”

According to Deputy Director of Legislative Services for the Ohio School Boards Association Will Schwartz, the previous formula had a host of shortcomings, including not using the income of residents in the distinct or changes in enrollment to determine the base cost.

“The formula the General Assembly decided to enact [before the Fair School Funding Plan] was a frozen formula that didn’t recognize any changes at the local level,” Schwartz said. “We weren’t using a base dollar amount that was derived from any sort of data. It was a base per-pupil amount that we just picked out of thin air.”

A legislative analysis concluded more than 80% of Ohio’s districts would receive between $7,000 and $8,000 in per-pupil base funding under this new formula. In the past, the formula relied heavily on property values to calculate this base number, but now property values and resident income are put into consideration to calculate the local contribution.

“The Fair School Funding Plan uses a more stable and predictable method of determining what the split between state and local funds looks like,” Kohler said. “Relying on both property values and resident income is really important for rural communities where farmers might have high property values, but their income may not be all that high. In the past, in rural communities, the local residents were expected to make up more money.”

Teacher salaries are part of determining the base cost, but according to Vice President for Ohio Policy at the Thomas B. Fordham Institute Chad Aldis, this is a flaw on multiple levels. The teacher salary data used is from 2018, already making it outdated, and the use of teacher salaries in this calculation could become unsustainable over time.

“If districts around the state use these dollars to increase teacher salaries, it would say that the average teacher salary is much higher, because everybody raised their teacher salaries,” Aldis told Spark. “That would then require a lot more state dollars. Most of us think they probably need higher teacher salaries, but whether they need it or not, local decisions will drive state costs, and that likely is unsustainable over time.”

The Lakota Educator’s Association (LEA) declined to comment at this time.

FUNDING

One big question surrounding the future of the Fair School Funding Plan is where the funds will eventually come from. The Department of Education’s General Revenue Fund and the profits from the Ohio Lottery are what finance Ohio’s 612 public school districts, 49 joint vocational school districts, 319 public community schools and seven Science, Technology, Engineering, and Math (STEM) schools. In addition, they fund the activities of the Ohio Department of Education, which includes funding for early childhood education, pre-school, special education, assessments, and the A-F report card.

Public schools in Ohio are funded by state funds, local sources like property taxes, federal funds, and, in select cases, income taxes.

“Funding has always been a partnership between the state of Ohio and the local school district,” Kohler said. “[The Fair School Funding Plan] works to equalize funding and provide additional state resources for schools and districts who do not have that local capacity and wealth to raise their revenues locally.”

Through property tax levies and other means for gaining funds, some districts are willing and able to spend more money, and nothing in Ohio law prohibits that.

“Many districts go to their voters and ask for additional resources and property tax levies, and those districts bring in significantly more resources,” Aldis said. “It’s really difficult for the state to figure out a way to get everybody the same amount of money as districts who tax themselves at extremely high rates that other communities are either unable or unwilling to pay.”

Mason City Schools passed a levy for the first time since 2005 in April, 2020 by nearly 70%, allowing the district to lean on local funds. Mason, like many suburban districts, is often subjected to flat funding, meaning there will be no cuts in state funding levels. Despite this, costs for school operations are increasing, forcing many districts to increase property taxes.

“In Mason, we’ve gotten used to [Ohio] stepping away from its responsibility to suburban school districts like ours,” Public Information Officer of Mason City Schools Tracey Carson said. “We tend to plan for flat funding. There’s a lot of emphasis on local communities to fill in the gap from the state budget.”

The Fair School Funding Plan adds $1.28 billion in new state fund spending in the 2022-2023 biennium for primary and secondary education compared to fiscal year 2021. The budget also increases state spending by $534.7 million, which is an increase of 5.6% in fiscal year 2022, before adding $203 million, another 2%, in fiscal year 2023.

While many are pleased with this increase in funding, some, like Schwartz, are fearful for its future, due to the fact only two of six years were approved.

“If you’re not concerned about the future of the Fair School Funding Plan then you’re not paying attention,” Schwartz said. “This is only two years of the six-year plan. That means it’s going to require not only one, but two general assembly budget processes to continue funding and building upon the formula. It means working with a new house speaker in the legislative session. The work is before us, and we know the challenges that lie ahead.”

Aldis feels similarly and explains that the plan greatly increases spending, but no new taxes were created to fund it.

“Over the next four or five years, the system may not get the resources it needs. If you found the plan that works, I think it makes sense to fund it, not to expect future legislators to fund it,” Aldis said. “I think the reason they didn’t do that is because they didn’t find the source of money to pay for it. Where does the money come from eventually?”

In addition, the Fair School Funding plan explicitly states funds must be used for their intended purpose.

“It’s put into law that we have to report on how we’re spending those funds,” Logan said. “With gifted specifically, if we don’t spend those funds on gifted kids, we have to send the money back.”

Even though Logan is pleased overall with the passing of the Fair School Funding Plan, she also sees this gap in its future success.

“I would have liked to have seen the six-year phasing that we had recommended to have stayed intact,” Logan said. “Specifically with poverty funds, we had recommended that that be fully phased in. It was phased in at a much slower rate than we recommended.”

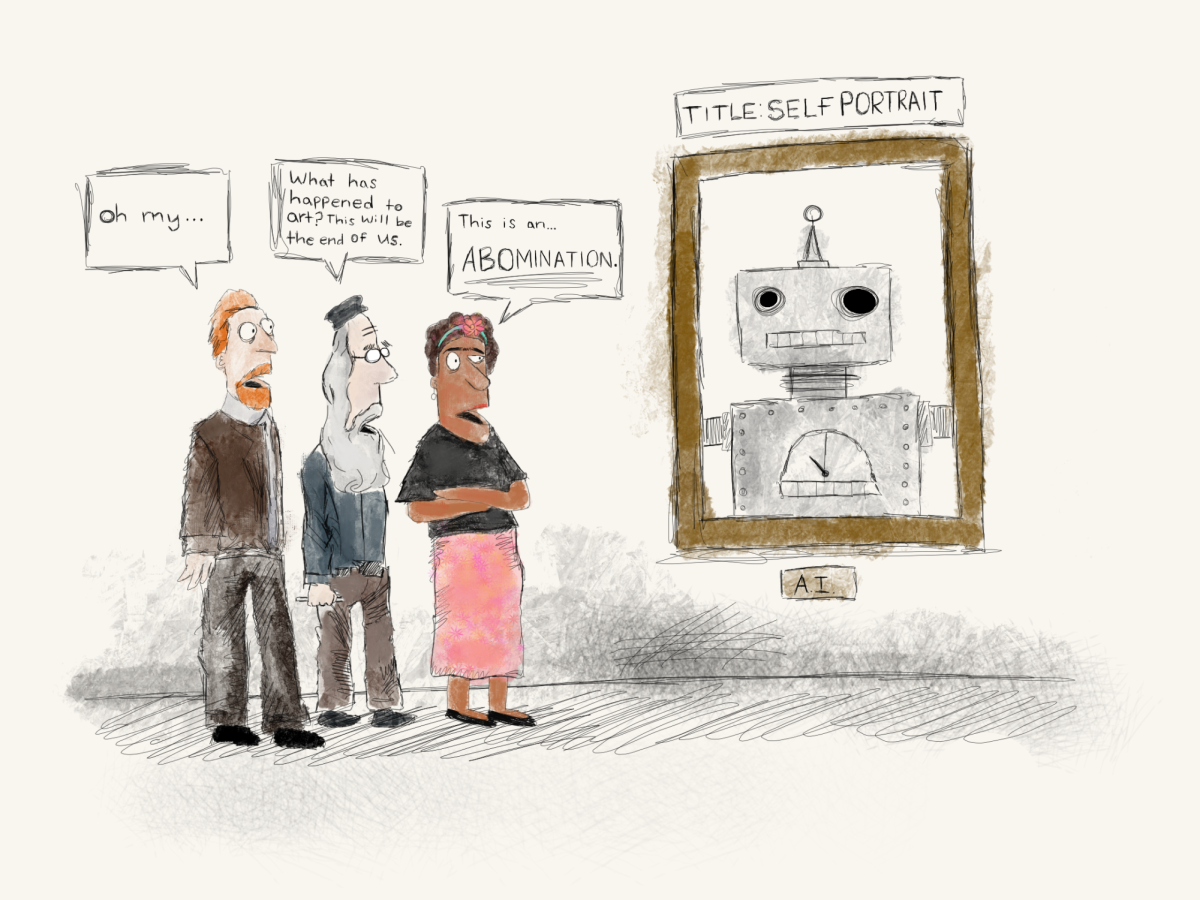

Although there is criticism, Aldis thinks the Fair School Funding Plan has made strides in creating an equitable system to fund Ohio Schools.

“There’s not one particular magical formula that is the right way to fund schools,” Aldis said. “Many people will say it should be a state responsibility, but at the end of the day, the state is made up of the state funding sources that come from Ohioans paying taxes.”

CHARTER SCHOOLS AND STATE VOUCHERS

Within the Fair School Funding Plan, the language around charter schools was altered. Now, charter schools and Ed-choice scholarships are funded directly from the state.

Any student entering grades K-12 whose family’s income is at or below 250% of the Federal Poverty Guidelines is eligible to apply for EdChoice scholarships in which the state pays for that child to attend a private school. Alternatively, charter schools, more commonly known as community schools in Ohio, are privately-run entities operating on public funds.

According to the Public School Review, there are five public charter schools serving 893 students in Butler County, with the top-ranked school being Middletown Prepatory and Fitness Academy. Even at the number one spot, this school earned two out of 10 in the Public School Review’s ranking.

In the past, money was filtered through the district in which the student attended, meaning the district would obtain additional funds that would then be sent to the appropriate charter or private school.

“It will simplify the budgeting process for our school treasurers in both charter schools and public schools,” Schwartz said. “It’s going to remove the adversarial relationship that’s existed between those two entities.”

Besides attending the public school assigned by location, Ohio students have the option to participate in Ed-choice scholarships or interdistrict open enrollment. About 80% of public districts in Ohio offer open enrollment; however, In Lakota, the Board of Education re-evaluates interdistrict open enrollment each year. Open enrollment is currently closed for the 2021-22 school year.

“For many years, students were funded [based on] where they lived, and then the funds were transferred if students and families did choose education options like schools scholarships, vouchers, or through open enrollment,” Kohler said. “Money won’t have to be transferred, therefore reducing animosity.”

Under the Fair School Funding Plan, EdChoice scholarships will increase $5,000 per student in grades K-eighth and $7,500 per student in grades nine-12. Charter schools are also now allowed to open in any district in the state.

Having “school choice,” according to Aldis, allows students to get the highest quality of education no matter socioeconomic status or location.

“Many times people in high wealth districts pay huge premiums to be able to live in those school districts. If they’re unhappy with the quality of the education, they’re better able to lobby for changes within the district to change district policy, or, if that fails, they can sell their house and move,” Aldis said. “It’s a bigger challenge for lower income families who don’t have all of the same resources, and for whom moving simply wouldn’t be an option.”

While charter schools and the subsequent state funds that accompany them give families greater options, Carson sees some issues with the increasing accessibility of charter schools.

“Some of the charter schools in the state are an entire other system of schools that are funded through the state’s taxpayer dollars but aren’t accountable to a local board of education and don’t have the same accountability measures,” Carson said. “It’s just a pipeline of money.”

According to a review conducted by the Akron Beacon Journal of 4,263 audits by State Auditor Dave Yost’s office, charter schools misspend public money nearly four times more often than any other type of taxpayer-funded agency.

“When you look at some of the charter schools in the past that Ohio has funded, their results have not been good for kids, and in many cases, there’s a lot of documentation about fraud,” Carson said. “Some of those charter schools have kids enrolled and not even attending. They’ve had issues with families being dissatisfied when they come back to their public school being farther behind.”

COVID MONEY

Due to the COVID-19 pandemic, schools in Ohio were awarded additional funds in the form of grants, some of which include Coronavirus Relief Funds (CRF) and the Elementary and Secondary School Emergency Relief (ESSER). According to Logan, Lakota will be using the $19.6 million in federal grants to continue to fund the following: the Virtual Learning Option (VLO), online curriculum, expanding 1:1 technology down to the third grade, nurses, and Lakota’s Learning Loss Recovery Plan. The Lakota District used 46% of these funds on technology, with the next highest usage being classroom supplies at 17%.

“There were so many additional costs associated with procuring buildings to safely educate students during a pandemic,” Kohler said. “The costs of really developing online learning applications and opportunities for students overnight were necessary but expensive.”

COVID-19 procured unheard of costs, meaning additional money necessary in order to continue educating students to the fullest capacity, according to Schwartz.

“Grants have provided a lifeboat to many schools and students, particularly in a time where Ohio’s school districts have suffered historic cuts,” Schwartz said. “What the federal pandemic emergency aid did was help shore up that lost revenue, and help provide more support to school districts to help address these acute issues brought on by COVID-19.”