Story by Michelle Chu | Photography Illustration by Christine Shi

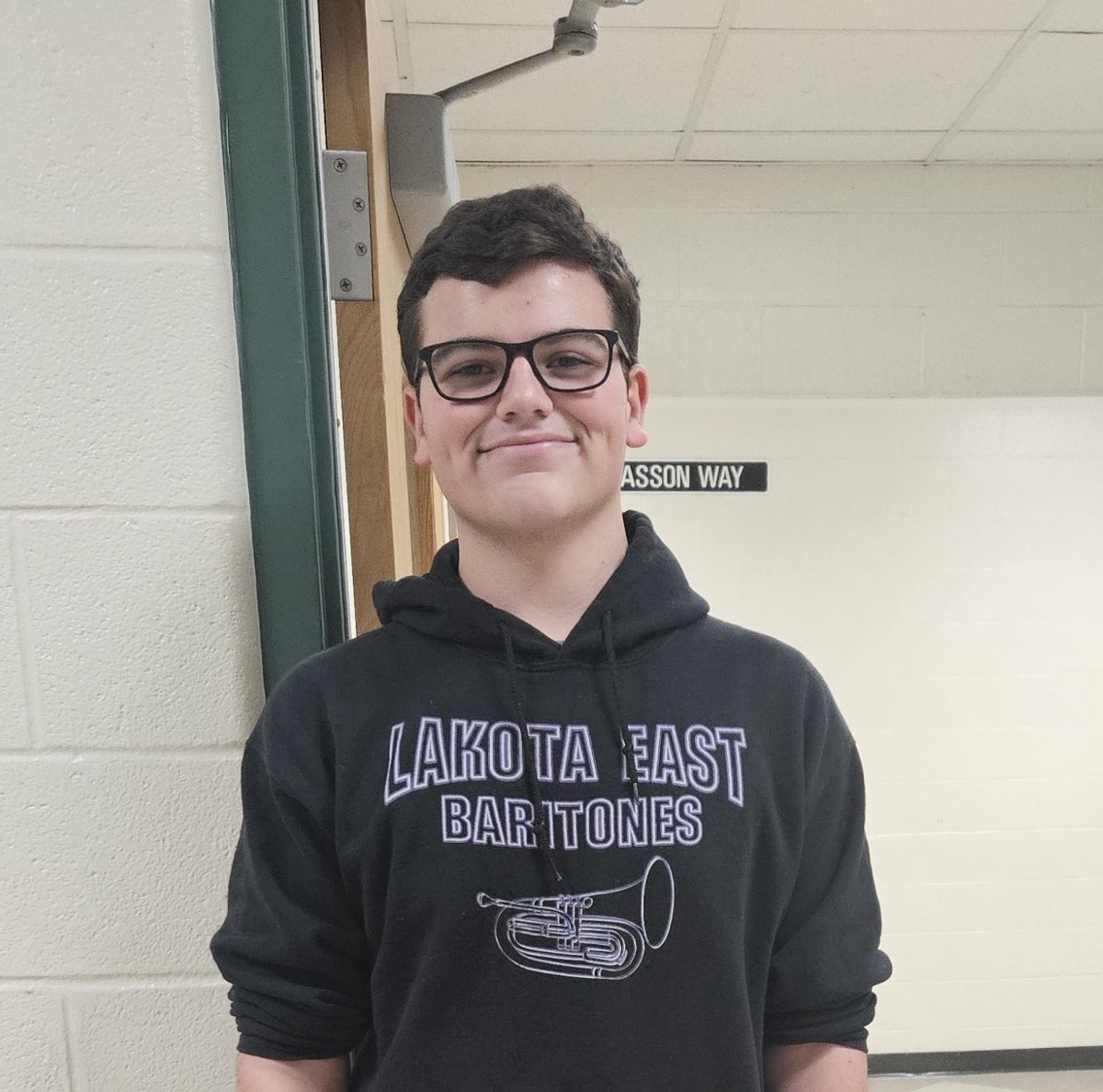

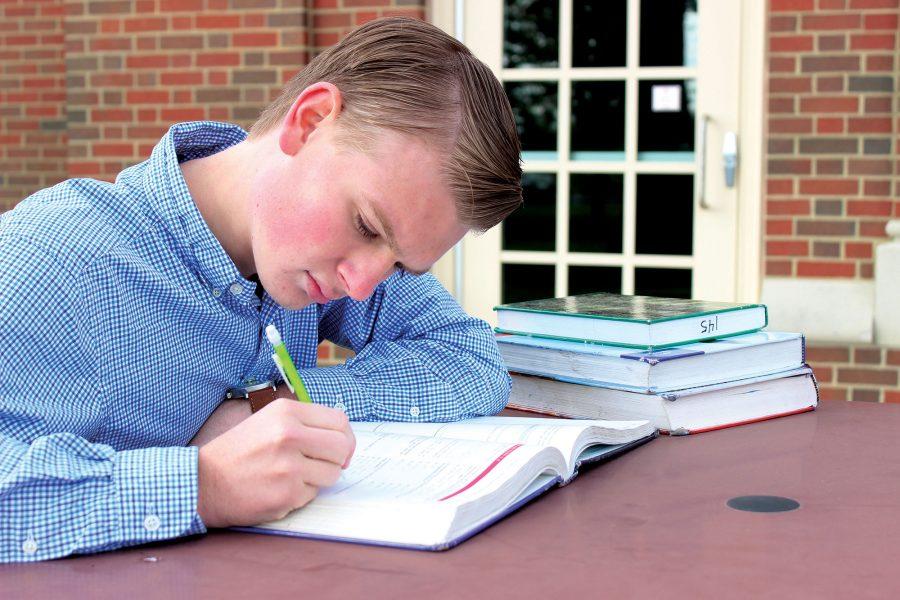

With his gelled hair, button-down shirts and Sperry boat shoes, East senior Mitch Bockhorst looks like he’s stepped out of a college catalogue. But before he’s introduced to campus as a college freshman next fall, he’s experiencing the struggles of an aspiring college applicant.

“When I’m looking at colleges, I’m like, ’I can’t go there,’ Bockhorst says. “I have a college list, and there’s times when [schools are] just off the list because I can’t afford them.”

Like many seniors, Bockhorst is applying to college this fall and winter. But rather than focusing on his academic and extracurricular résumé, he and an increasing number of students find limitations because of tuition costs.

Universities in the late 20th century combatted the increasing enrollment of students by utilizing the substantial government support to build new facilities. Now faced with the upkeep of these buildings and construction of new ones, in addition to absorbing the federal and state support lost during the Great Recession, universities have turned to students to pay more of their own way.

Tuition costs first increased in the late ‘70s and ‘80s. More students applying meant that universities had to compete for the best students, according to the University of Cincinnati Chapter President of the American Association of University Professors (AAUP) Greg Loving. Colleges hired more administrators to work with student services, government and other agencies to balance the rate of student enrollment.

Loving adds that university presidents and top administrators are paid similarly to CEO and corporate board members. According to the Chronicle of Higher Education, a news and information publication which includes salary databases, the average public college president earned 3.8 times the salary of an average full-time professor. Former Pennsylvania State University President Rodney Erickson was the top-paid public college president in the 2013-14 year with a salary of $1.4 million.

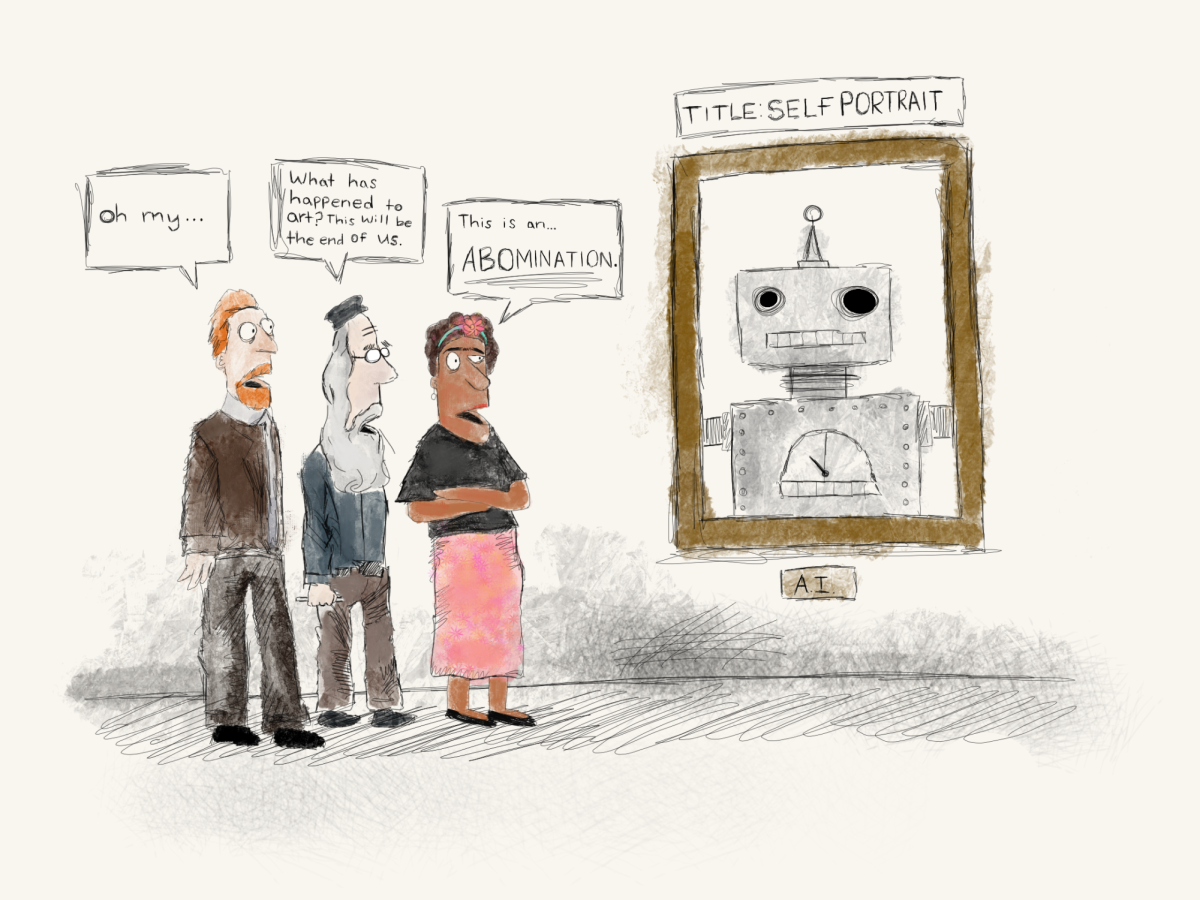

While college president compensation is increasing, professor salaries fail to keep up. Full-time professor salary is “rather flat,” Loving tells Spark, and more part-time adjunct professors are being hired. Students don’t realize that many of their professors are part-time and don’t have offices, which can be difficult if the student wishes to meet with their professors during out-of-class hours.

Bockhorst attributes the quality of education to professors and believes that professor salary is the “most important money to spend.” While adjunct professor salaries are difficult to measure, a 2015 University of California Berkeley report found that 25 percent of part-time college faculty rely on public assistance.

In a 2015 Gallup and Purdue University survey, about 50 percent of public and private university students strongly agreed that their education was “worth the cost.”

“If you did that survey 10, 15 or 20 years ago, you would see a very different response,” Executive Director of Ohio Campus Compact Richard Kinsley tells Spark. “You would have a higher response that it was worth the expense and the time. That’s a fairly low and concerning number.”

He credits students’ appreciation of their education to the question recent college graduates ask themselves when they compare their starting income to monthly loan payment. Yet students still want the experience of college and individual growth that they would not get elsewhere.

After decades of competition among colleges, expenses for building the best facilities, and providing more amenities to attract incoming freshman has added up and has become apparent to families paying these elevated tuition and boarding expenses. Dormitories and other buildings from the 80s need maintenance or complete reconstruction, Kinsley says. For example, The Ohio State University (OSU) has five fitness centers, and the Recreation and Physical Activity Center, completed in 2007, had a cost of $140 million itself, according to Best Value Schools.

State and local funds for 621 four-year public institutions dropped $2,730 per student from the 2006-07 school year to 2012-13 school year. As a result of the decreased financial support from the state and national government, private universities rely on alumni fundraisers. For the colleges that have athletic stadiums built because of wealthy donor funds, Loving adds that there is still the issue of stadium upkeep that the university and eventually the students will have to provide.

In addition to these expenses, the Great Recession of 2008 caused prices to jump noticeably for students and their families.

“Until the [Great] Recession hit, you didn’t see big cuts [to state and federal education funds],” Kinsley says. “Once the big federal and state cuts started taking place for public institutions, then the natural place for campuses to offset these cuts was to raise tuition and housing fees.”

According to the College Board, a decade ago, the average cost of tuition for in-state students at a four-year public university in Ohio was $8,236. For the 2014-15 school year, the average Ohio cost is $10,100, whereas the national average is $9,139.

“Ohio has been following the trend [of the nation],” Kinsley says. “There have been cuts to campuses over the past years by state legislatures. That’s pretty much across the country.”

Still, the national and state government have continued to lend some help to these institutions. In Ohio, Governor John Kasich created the Ohio Task Force on Affordability and Efficiency in Higher Education. It released a report in early October with reviews and recommended to state-sponsored higher education institutions, such as public four-year universities and two-year community colleges, to provide equal or higher quality education at lower costs.

Inflation has little to do with adding to the cost of tuition and room and board. Before, increases primarily kept pace with tuition, Kinsley says. But now, according to a Consumer News and Business Channel study, Harvard University’s annual tuition for the 2015-16 school year, not including room and board, is $45,278, which is more than 17 times the price in the 1971-72 school year. If increases had been due to inflation, then tuition would be just $15,189.

In order to overcome these reductions in federal and state support along with building upkeep and construction, colleges pass the financial burden to students. In turn, students, such as Bockhorst, and their families often take out student loans.

East economics teacher Amy Florence also considers alternative ways to help pay for college for her two children, who are a freshman and a seventh grader in the Lebanon school district. Like Bockhorst’s parents, she and her husband will pay partially, but it is up to her kids to find ways to afford the rest of the cost of tuition and boarding.

“One of the things we’ve considered is selling our house and using the profits to help fund [our children’s] education,” Florence says. “The cost has become so high that we’re not going to be able to pay for it a hundred percent, and they’re going to have to either get scholarships and/or take loans.”

According to The Institute for College Access and Success, 69 percent of public and nonprofit college students in the college class of 2013 had student loan debt, with the average amount of debt at $28,400.

Even families like Florence’s with children in middle school are looking for when college costs will decrease. Loving predicts that this will not happen until three or four decades from now.

“It took 30-40 years to get into this [high college expense],” Loving says. “I am not rosy that it will be any less than that [amount of time].”

He points to this because while, according to the National Student Clearinghouse Research Center, total institutional enrollment decreased from 19,105,651 in spring 2013 nationally to 18,592,605 in spring 2015, colleges like UC still have a number of students enrolling to keep the campuses running.

“UC has very little motivation to change anything—very little motivation other than the state trying to make them lower tuition,” Loving says, which aligns with the recent report by Kasich’s Task Force.

Still, the alternative to this 30-40 year timeline may be the “next big [economic] crash.” Loving warns that it will be a combined effort of students, colleges and politicians to prevent drastic changes and this so-called crash. Until there is bipartisan support for higher education, there will be no effective change in federal support.

In early 2015, President Barack Obama announced his initiative for two years of free community college tuition. Such alternative options, like technical schools or community colleges, can be utilized by students to at least slow down the rapid increases, Kinsley says.

Still that can be a tough decision for students like Bockhorst who are looking for the prestige of a four-year university. Even among them, he places different schools at different standards.

His dream schools are Massachusetts Institute of Technology (MIT) and Stanford University, but he realizes how little aid and scholarships he could receive compared to if he attended OSU or Miami University next fall. He worries that if he enrolled into a more pricey college such as MIT or Stanford, the debt gap will be greater than the sophistication of his education.

“It comes to a point where it’s not going to be worth it with that much money for education that really isn’t that much higher quality than a cheaper [college],” Bockhorst says. “I keep lying to myself that it should be worth it, but I know it’s not going to be.”