Politicians are notorious for disagreeing with the general public, professionals, and each other. When it comes to economics they are no different; they blame the bad times on the other party, and take credit for the good ones.

President Donald Trump has announced that on April 2, he will impose new 20% tariffs on Chinese imports, reinstate 25% tariffs on global steel and aluminum imports, and impose 25% tariffs on imports from Canada and Mexico, according to Reuters, an international news agency known for its bipartisan reporting.

He has framed tariffs as a tool to attempt to convince these countries to take active steps to decrease the influx of undocumented immigrants and the smuggling of illegal drugs into the U.S..

Trump attempting to use tariffs to scare other countries into compliance will not have the effects that he wants however, and will hurt the U.S. more than the other countries.

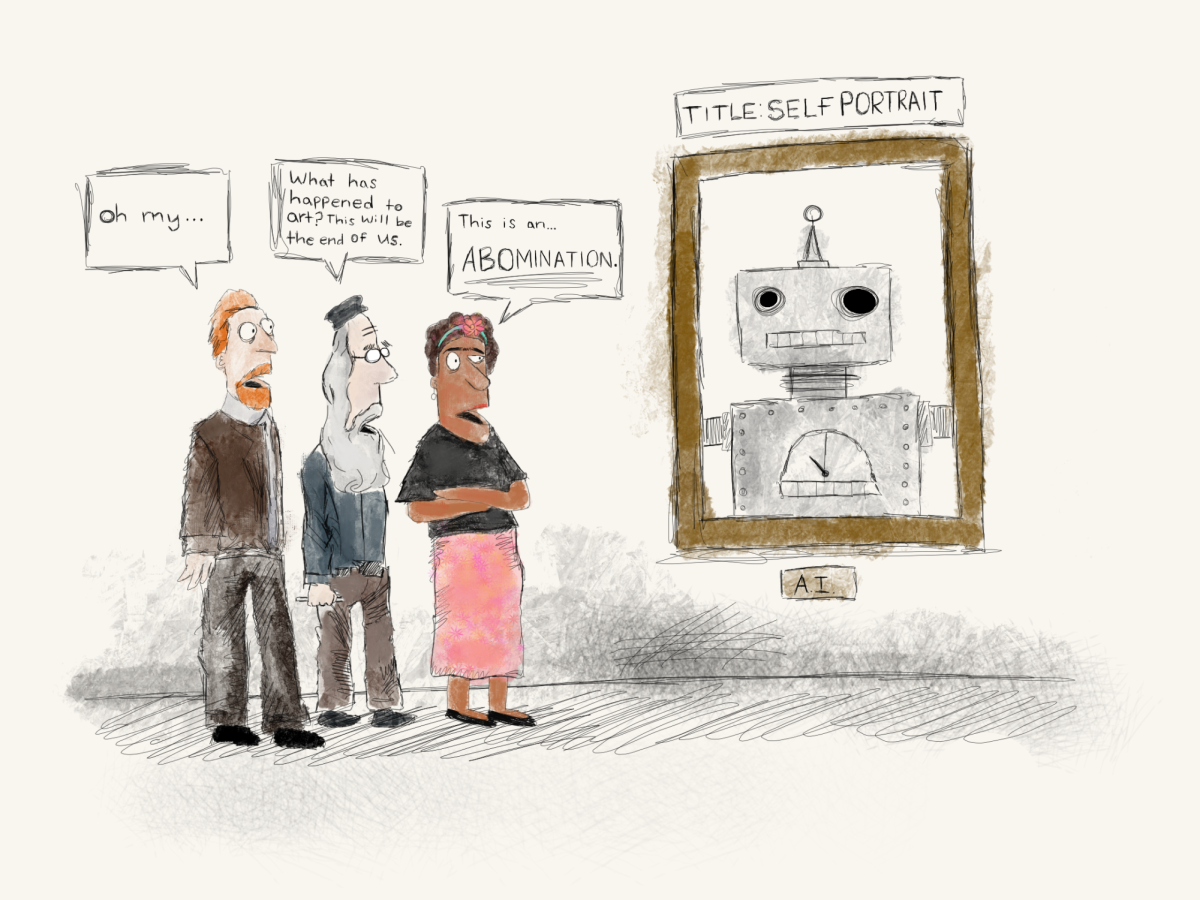

When it comes to “the dismal science” economists often disagree with each other too, but there are some fundamental principles that even an AP Economics student would recognize.

Namely that free international trade is what is healthiest for the economy.

According to the Adam Smith Institute, in his book, published 1776, “The Wealth of Nations,” Adam Smith, the “Father of Capitalism” himself, stressed the idea that “[the government’s] core functions are maintaining defense, keeping order, building infrastructure and promoting education. It should keep the market economy open and free, and not act in ways that distort it.”

Similarly, since the days of the Boston Tea Party, there is one thing that most Americans can agree on: no one likes taxes.

According to the Economic Policy Institute, many people do not know that tariffs are actually taxes on imported foreign goods and are the burden of the American importer, and ultimately the American consumer.

When two countries each specialize in making one product and then trade those products, more of each can be made at lower prices, according to Review Econ.

When the government of one country implements a tariff on the goods from a different country, the price of the imported goods are raised, which allows domestic producers to charge more for their products without having to pay for the tariff.

Businesses that import items however, must pay the tariff, which is revenue that goes to the Federal Government, forcing them to charge consumers a high price to cover the cost of paying for the tariff.

In some ways, tariffs may not seem so bad, as they can help protect domestic businesses and provide the government with tax revenue, according to the Economic Policy Institute.

Tariffs placed on other countries’ imports to the U.S. increase the price of those goods for the U.S. consumer, which may encourage U.S. consumers to buy domestically. This has the ability to promote the growth of American businesses.

A problem arises when “tariff” is considered “the most beautiful word in the dictionary,” to quote Trump in an address to the Economic Club of Chicago in Oct. of 2024.

Trump and his administration are mainly posing these tariffs on Canada, Mexico, and China as a way to stop illegal immigration and the importation of drugs into the U.S., according to the White House website.

By posing tariffs as a threat instead of using them as a means to promote American businesses, other countries may take this as an act of aggression and turn against the U.S.

This is extremely concerning when taking into consideration the fact that the newly placed tariffs on Canada and Mexico violate the United States-Mexico-Canada Agreement (USMCA).

This trade agreement limits the tariffs that each country involved can place on one another in order to promote the economies of all three. Trump has attempted to make an exception for his new tariffs by claiming a national emergency.Initially if these tariffs are placed, prices on imports may become so high, that the U.S. could see an increase in inflation. If the situation were to become a trade war however, there would be a high likelihood of the U.S. falling into a recession.

If a trade war were to ensue, the amount of U.S. exports would decrease because price levels of U.S. goods would be driven up too high for other countries to purchase, according to the Tax Foundation.

This would decrease overall demand for American goods, which would lower price levels and the U.S. Gross Domestic Product (GDP). GDP is how much a country produces domestically.

When demand goes down, supply must follow so that companies do not lose money. This also means that companies must cut costs because they are not producing as much.

These costs would include workers, which would increase unemployment in the U.S. Increased unemployment and decreased prices are characteristics of a recession.

This is not the first time that misguided tariffs have broken down the American economy.

In 1930 the U.S. government imposed the Smoot-Hawley Tariff which aimed to help the U.S. out of the Great Depression. Rather, it encouraged retaliatory tariffs from other countries, worsening the recession.

Trump is hurting relationships with America’s most traded with countries, especially the relationship among the largest countries in North America.

This leads there to be one last thing that economists generally agree on: Trump’s tariffs are not the right thing for the U.S. economy.